Food Service Equipment Market Size to Worth USD 84.96 Billion by 2035 | Towards FnB

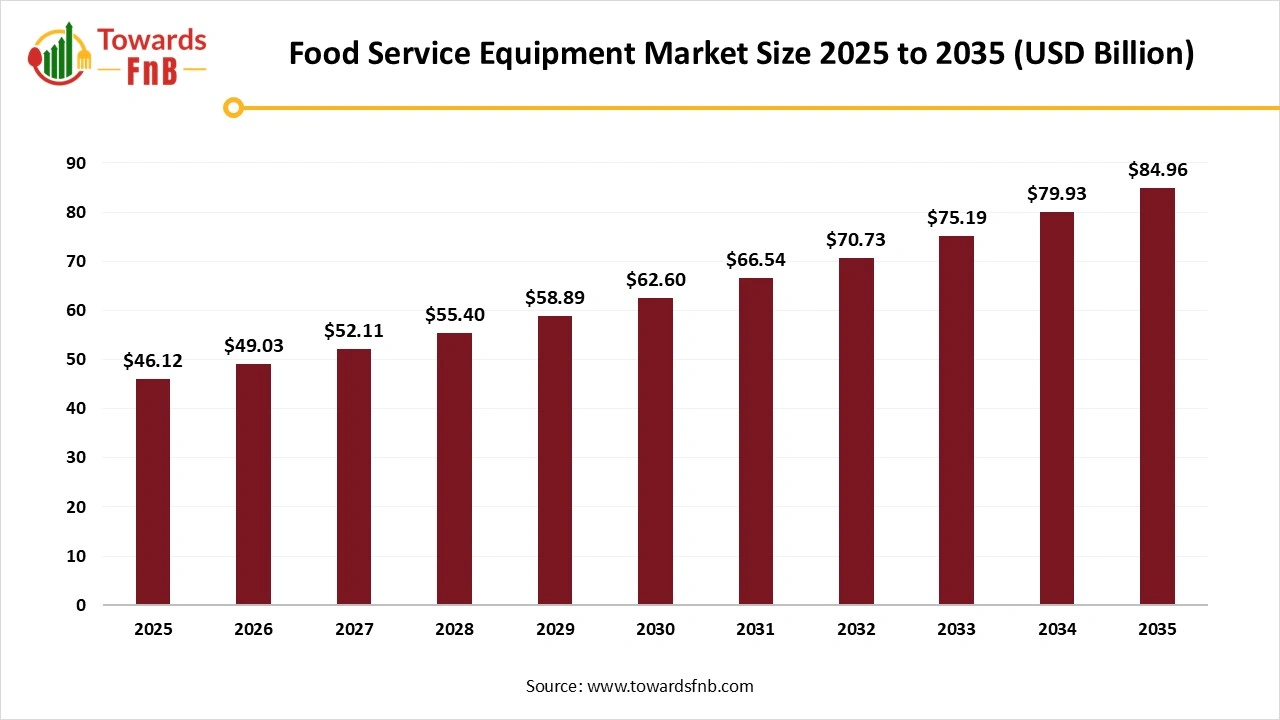

According to Towards FnB, the global food service equipment market size is calculated at USD 49.03 billion in 2026 and expand to approximately USD 84.96 billion by 2035, registering at a CAGR of 6.3% from 2026 to 2035. This growth reflects a structural shift toward automated, energy-efficient, and digitally connected kitchen systems, as foodservice operators worldwide prioritize efficiency, food safety, and scalability amid labor shortages and rising operating costs.

Ottawa, Jan. 06, 2026 (GLOBE NEWSWIRE) -- The global food service equipment market size stood at USD 46.12 billion in 2025 and is predicted to grow from USD 49.03 billion in 2026 to reach around USD 84.96 billion by 2035, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow in the foreseeable period due to the expansion of catering services, food services, commercial kitchens, quick-service restaurants, and other similar food service forms. The market is also experiencing growth due to a growing population, which leads to higher demand for global cuisines.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5967

Key Highlights of the Food Service Equipment Market

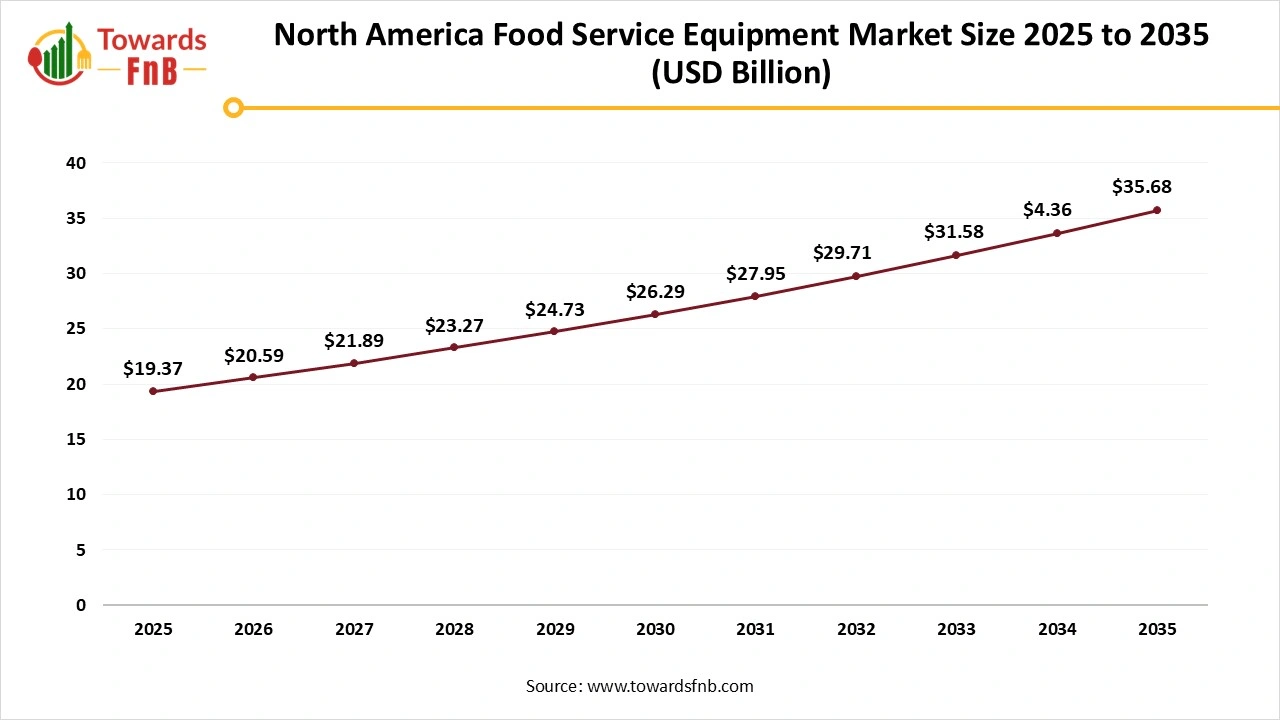

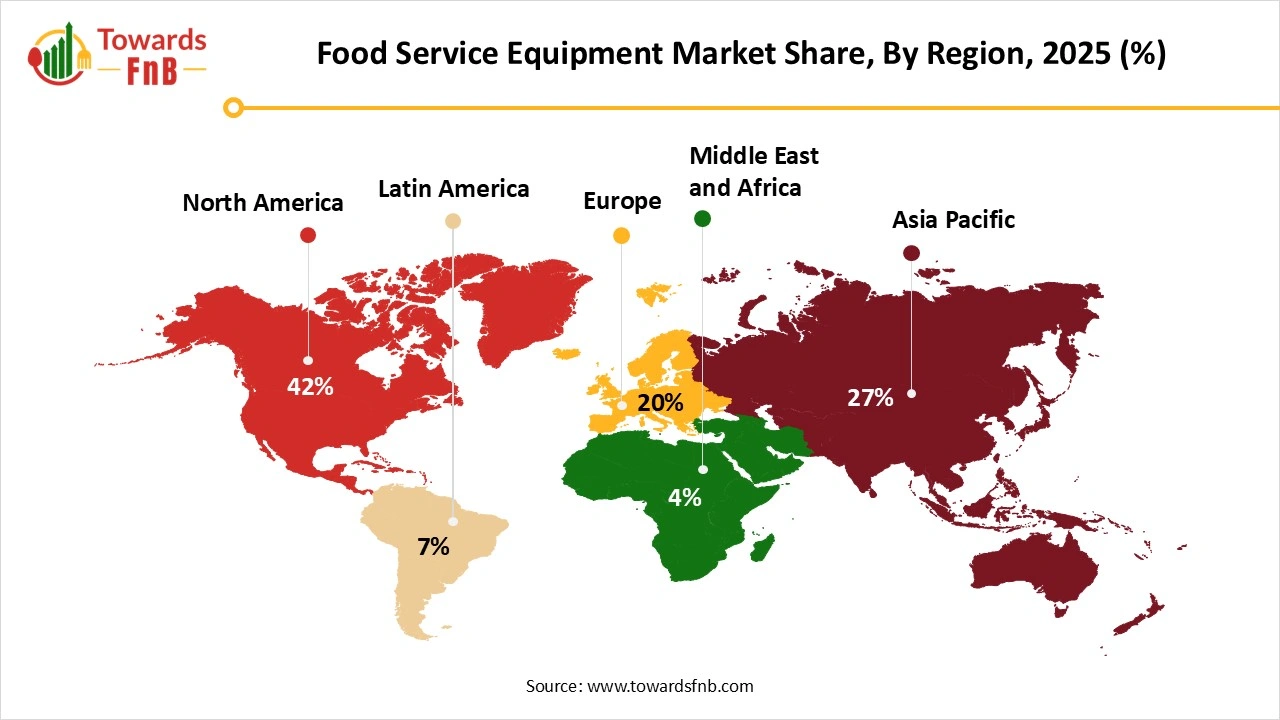

- By region, North America led the food service equipment market with a revenue share of 42% in 2025, while the Asia Pacific region is expected to grow at the fastest rate during the forecast period. Europe is also projected to experience notable growth during the same period.

- By equipment, the cooking equipment segment accounted for a major revenue share of 32.7% in 2025. However, the refrigeration equipment segment is projected to grow at the fastest CAGR between 2026 and 2035.

- By end user, the Full-Service Restaurants (FSR) segment held the largest revenue share of 34.8% in 2025. On the other hand, the Quick Service Restaurants (QSR) segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By distribution channel, the dealers and distributors segment led the market with a significant revenue share of 62.3% in 2025, while the online retailers segment is projected to grow at the fastest CAGR during the forecast period (2026-2035).

-

By application, the commercial kitchen segment accounted for the largest revenue share of 54.5% in 2025. However, the cloud/ghost kitchen segment is projected to grow at the fastest CAGR between 2026 and 2035.

Higher Demand for Food Safety and Quality Aids the Growth of the Food Service Equipment Industry

The food service equipment market observes growth due to growing dining experiences and higher demand for restaurants, quick service restaurants, and cloud kitchen. The market also observed growth due to the growing culture of food delivery by consumers with a hectic lifestyle. Higher demand for technologically advanced kitchens equipped with features such as AI and IoT also help to improve food quality, safety, and efficiency, propelling the growth of the market. Such features also help to manage energy resources and maintain sustainability.

Impact of AI in the food service equipment market

Artificial intelligence (AI) is influencing the food service equipment market by improving operational efficiency, equipment reliability, and consistency in commercial kitchens across restaurants, hotels, institutional catering, and quick service formats. In equipment design and operation, AI driven systems analyze usage patterns, load conditions, and cooking cycles to optimize the performance of ovens, fryers, grills, refrigeration units, and beverage dispensers. Sensors track temperature stability, energy consumption, and cooking time in real time, while machine learning models adjust settings to ensure uniform output and reduce human error during peak service hours.

Predictive maintenance is a key area of impact. AI models monitor vibration, heat buildup, and component wear in equipment such as combi ovens, mixers, and dishwashers. These systems identify early signs of mechanical failure and recommend maintenance before breakdowns occur. This reduces downtime, prevents service disruption, and lowers long-term repair costs for food service operators.

Technologically Advanced Equipment Aiding the Growth of the Food Service Equipment Market

- Smart and Combi Ovens- Such equipment is multi-functional and can be used for various purposes, such as cooking, steaming, and retaining nutrients to enhance food quality and safety. They are also equipped with technological features such as sensors, programmed recipes, and convection, further fueling the growth of the market.

- Kitchen Display Systems- Digital screens to keep a tab on cooking time, manage staff, and maintain the order alley, help to fuel the growth of the market and allow commercial kitchens to operate effortlessly.

-

IoT Sensors and Connected Fridges- The technologically advanced equipment helps to manage the shelf life of food and beverages, monitor temperatures, prevent spoilage, and alert managers about any kind of issues.

Recent Developments in Food Service Equipment Market

- In July 2025, Hoshizaki America Inc. launched Valiance by Hoshizaki, a new line of refrigeration equipment. The company claims that the new line is a cost-friendly option for operators and was unveiled at the 2025 National Restaurant Association Show.

- In July 2025, GoTo Foods signed a deal to develop 45 locations by 2033 in India for a concept called Moe’s Casa Mexicana. It is a spinoff of Moe’s Southwest Grill with international growth. The new concept will include Mexican cuisine with local preferences, flexible stores, and full-scale, in-line, dine-in, and kiosk options.

New Trends in the Food Service Equipment Market

- Higher demand for enhanced food quality and safety is one of the major factors for the growth of the market.

- Enhanced demand for food safety, sustainability, and energy efficiency also helps to fuel the market’s growth.

- Growing startups in the industry with high food safety, quality, and sustainability concerns also help to fuel the market’s growth.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-service-equipment-market

Food Service Equipment Market Dynamics

What are the Growth Drivers of Food Service Equipment Market?

Various factors, such as growing disposable income, rapid urbanization, and higher demand for food quality and safety, are some of the major factors for the growth of the market. The market also observes growth due to higher demand for technologically advanced equipment enhanced with features such as AI and IoT, further fueling the growth of the market. Enhanced food quality and efficiency in commercial kitchens also help to fuel the market’s growth. Hectic consumer lifestyles leading to growth in food delivery services also help to fuel the market’s growth. Such equipment is also energy efficient and sustainable, further helpful to propel the market’s growth.

Higher Costs and Equipment Hampering the Market’s Growth

Higher costs required for purchasing technologically advanced machinery are one of the major restraints in the growth of the market. Higher costs required for installation, maintenance, and the experienced labor required to operate the advanced machinery are also some of the factors hampering the growth of the food service equipment market. Hence, such factors altogether hamper the market’s growth if not paid attention to at the right time by the industry.

Automation and Smart Kitchens are Helpful for the market’s Growth

Smart and advanced kitchen setups and equipment help to fuel the growth of the market. Such equipment helps to manage the energy resources and also helps to maintain sustainability, which is helpful for the market’s growth. Such equipment also helps to boost the growth of the market as it helps to enhance the food quality and quantity and manage efficiency. Technology-driven AI and IoT also help to improve efficiency and overcome labor gaps, further fueling the growth of the market.

Product Survey of the Food Service Equipment Market

| Product Category | Description or Function | Common Equipment Types or Variants | Key Applications or End-Use Segments | Representative Manufacturers or Supplier Types |

| Commercial Cooking Equipment | Equipment used for primary cooking and heat processing. | Ranges, ovens, grills, fryers, tilting pans | Restaurants, hotels, QSRs | Rational, Vulcan, Garland |

| Commercial Ovens | Thermal equipment for baking, roasting, and reheating. | Convection ovens, combi ovens, deck ovens | Bakeries, hotels, institutional kitchens | Rational, UNOX, Middleby |

| Commercial Refrigeration Equipment | Cold storage and display systems for food safety and freshness. | Reach-in refrigerators, freezers, walk-in coolers | Restaurants, supermarkets, cloud kitchens | True Manufacturing, Hussmann |

| Food Preparation Equipment | Equipment used for cutting, mixing, grinding, and portioning. | Food processors, mixers, slicers, choppers | Restaurants, catering, commissary kitchens | Robot Coupe, Hobart |

| Warewashing Equipment | Automated systems for cleaning utensils and cookware. | Conveyor dishwashers, undercounter dishwashers | Hotels, hospitals, large kitchens | Hobart, Meiko |

| Commercial Beverage Equipment | Equipment for preparing hot and cold beverages. | Coffee machines, juice dispensers, soda fountains | Cafés, bars, QSRs | La Marzocco, Franke |

| Cooking Automation and Smart Kitchen Equipment | Digitally controlled systems optimizing cooking consistency and labor efficiency. | Programmable fryers, smart ovens | Chain restaurants, QSRs | Middleby Innovation Kitchens, Rational |

| Food Holding and Warming Equipment | Equipment maintaining food temperature before service. | Holding cabinets, heat lamps, warming drawers | Buffets, catering services | Alto-Shaam, Hatco |

| Bakery Equipment | Specialized equipment for dough handling and baking. | Dough mixers, proofers, sheeters | Bakeries, pastry kitchens | Buhler, Rheon |

| Meat and Seafood Processing Equipment | Equipment for cutting, grinding, and portioning proteins. | Meat slicers, grinders, saws | Butcher shops, hotels | Bizerba, Marel |

| Ventilation and Exhaust Systems | Systems for air management and safety in kitchens. | Range hoods, grease filters | Commercial kitchens | Halton, CaptiveAire |

| Food Service Storage Equipment | Non-refrigerated storage solutions for ingredients and utensils. | Shelving systems, ingredient bins | Restaurants, catering kitchens | Metro, Cambro |

| Ice Machines | Equipment producing ice for foodservice and beverage use. | Cube ice makers, flake ice machines | Restaurants, bars, hospitals | Manitowoc Ice, Scotsman |

| Display and Serving Equipment | Equipment used for food presentation and service. | Buffet counters, display cases | Hotels, cafeterias | Vollrath, Cambro |

| Food Safety and Sanitation Equipment | Systems ensuring hygiene and regulatory compliance. | Handwash stations, sanitizer units | Institutional kitchens | Ecolab, Diversey |

| Energy Efficient Foodservice Equipment | Equipment designed to reduce energy and water usage. | ENERGY STAR certified appliances | Sustainable kitchens | Multiple OEMs |

| Modular and Mobile Kitchen Equipment | Portable and modular units for flexible operations. | Mobile cooking stations, food trucks | Events, pop-up kitchens | Mobile kitchen manufacturers |

| Institutional Foodservice Equipment | Heavy-duty equipment for large-scale meal preparation. | Bulk cooking kettles, tray lines | Hospitals, schools, prisons | Middleby, Ali Group |

| Cloud Kitchen and QSR Optimized Equipment | Compact, high-throughput equipment for delivery-focused models. | High-speed ovens, compact fryers | Cloud kitchens, QSR chains | TurboChef, Merrychef |

| Customized Foodservice Equipment Systems | Tailored kitchen layouts and integrated equipment solutions. | Turnkey kitchen systems | Hotels, large chains | Kitchen system integrators |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5967

Food Service Equipment Market Regional Analysis

North America led the Food Service Equipment Market in 2025

North America dominated the food service equipment market in 2025, due to growing demand for different types of food services in the region, such as cloud kitchens, quick service restaurants, and restaurants. Higher demand for technologically advanced equipment connected with AI and IoT also helps to fuel the market’s growth. Such equipment helps to enhance food’s quality, quantity, and efficiency, further fueling the growth of the market. The US has made a major contribution to the growth of the market in the region due to the higher demand for food in bulk quantities from different types of food service platforms.

Asia Pacific is observed to be the Fastest-Growing Region in the Foreseen Period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to higher demand for technologically advanced kitchens and equipment. Such equipment helps to enhance efficiency in case of bulk preparations to feed the demands of the growing population. Equipment enabled with AI and IoT helps to enhance the food quality and quantity, along with aiding time management, further fueling the growth of the food service equipment market in the foreseeable period. Countries such as India and China have made a major contribution to the growth of the market due to factors such as growing disposable income, rapid urbanization, and higher demand for smart kitchens to maintain food quality and efficiency.

Europe is observed to have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to higher demand for smart kitchens and smart equipment in the region, fueling the growth of the market. Higher demand for food in bulk quantities, along with enhanced food safety, is another major factor for the market’s growth. Higher demand for eco-friendly equipment and maintained sustainability also helps to fuel the market’s growth. Germany has made a major contribution to the growth of the market of the region due to the growing popularity of food service platforms such as quick service restaurants, restaurants, and cloud kitchens.

Trade Analysis for the Food Service Equipment Market

What Is Actually Traded (Product Forms and HS Proxies)

- Commercial cooking equipment, such as ovens, fryers, and grills, is typically declared under HS 8419 and HS 8516 depending on the heating method.

- Refrigeration and cold-storage equipment for foodservice use, commonly classified under HS 8418.

- Food preparation machinery, including mixers, slicers, and processors, is often cleared under HS 8438.

- Warewashing equipment, such as dishwashers and glasswashers, is generally declared under HS 8422.

- Spare parts, modules, and accessories are supplied separately, classified under corresponding machinery headings.

Top Exporters (Supply Hubs)

- China: Largest exporter of food service equipment globally, supported by large-scale manufacturing, competitive costs, and broad product coverage.

- Italy: Major exporter of premium cooking, espresso, and food-preparation equipment, supported by strong engineering and hospitality-equipment clusters.

- Germany: Exporter of high-efficiency cooking, refrigeration, and warewashing equipment, driven by precision engineering and regulatory compliance expertise.

- United States: Exporter of branded commercial kitchen equipment and integrated systems for global foodservice chains.

Top Importers (Demand Centres)

- United States: Largest importer of food service equipment due to extensive restaurant networks, replacement demand, and chain expansion.

- European Union: Strong intra-EU and extra-EU imports driven by hospitality, institutional catering, and tourism sectors.

- Middle East: High import demand linked to hotel development, tourism investment, and reliance on imported equipment.

- Southeast Asia: Growing imports driven by urbanization, modern retail foodservice, and international franchise expansion.

Typical Trade Flows and Logistics Patterns

- Finished equipment is shipped from manufacturing hubs in Asia, Europe, and North America to destination markets via containerized sea freight.

- Large or customized kitchen systems may ship in multiple consignments and require on-site assembly.

- Spare parts and replacement modules are often shipped by air to minimize equipment downtime.

- Regional distribution centers handle final configuration, compliance labeling, and after-sales logistics.

Trade Drivers and Structural Factors

- Foodservice expansion: Growth of quick-service restaurants, cloud kitchens, and catering supports sustained equipment demand.

- Automation and labor efficiency: Equipment with higher throughput and reduced manual handling gains preference.

- Energy and water efficiency: Rising utility costs and regulations influence purchasing decisions.

- Hygiene and safety standards: Enhanced sanitation requirements drive replacement and upgrade cycles.

-

Standardization by chains: Global restaurant chains prefer approved equipment lists, shaping trade concentration.

Regulatory, Quality and Market-Access Considerations

- Food service equipment must comply with electrical safety, gas safety, pressure vessel, and food contact material regulations.

- Energy efficiency and environmental standards affect market access in many regions.

- Certification, conformity marking, and technical documentation are required prior to import.

- Installation often requires local licensing and inspection, influencing delivery timelines.

Government Initiatives and Public-Policy Influences

- Energy-efficiency standards and eco-design regulations influence equipment design and trade eligibility.

(Source: https://www.iea.org/topics/energy-efficiency-standards-and-labelling) - Hospitality and tourism development policies indirectly stimulate food service equipment imports.

- Trade facilitation measures affect tariffs and customs procedures for capital equipment.

Food Service Equipment Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 6.3% |

| Market Size in 2026 | USD 49.03 Billion |

| Market Size in 2027 | USD 52.11 Billion |

| Market Size in 2030 | USD 62.60 Billion |

| Market Size by 2035 | USD 84.96 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food Service Equipment Market Segmental Analysis

Equipment Analysis

The cooking equipment segment led the market in 2025, due to the expanding food industry led by the growing population. Such cooking equipment helps to manage the food quantity, quality, efficiency of preparation, and time management seamlessly. Hence, such factors help to fuel the growth of the market. Commercial equipment, such as fryers, grills, and ovens, helps to enhance the efficiency of preparation and is also multifunctional in a commercial kitchen, further fueling the growth of the market. Commercial equipment also helps to streamline operations and manage efficiency, while handling a large quantity of food further fuels the growth of the market.

The refrigeration equipment segment is expected to grow in the foreseeable period, as the segment focuses on enhancing the food shelf life, quality, and safety of the prepared food options and ingredients. It helps to enhance the growth of the industry and also maintain complete safety. The segment plays a crucial role in hospitals, quick service restaurants, restaurants, and huge commercial kitchens, ensuring food safety and quality in bulk quantities, further fueling the growth of the food service equipment market.

End Use Analysis

The full-service restaurant segment led the food service equipment market in 2025, due to growing demand for global cuisines and food in large quantities to serve the growing population. Higher demand for technologically advanced equipment in different types of food service kitchens and restaurants is another major factor for the growth of the market. Such restaurants need high-tech equipment for the preparation and storage of food in bulk quantities to ensure its shelf life and safety, which is helpful for the market’s growth.

The quick service restaurants segment is expected to grow in the expected timeframe due to their higher demand by consumers with a hectic lifestyle and those who are on a time crunch. Such restaurants have automatic dispenser machines, self-service kiosks, automated air fryers, and various other technologically advanced equipment to serve consumers on a large scale, further fueling the growth of the market in the foreseen period.

Distribution Channels Analysis

The dealers and distributors segment led the food service equipment market in 2025, as the segment bridges the gap between the operators and manufacturers, which is helpful for the market’s growth. The segment also focuses on providing vital sales support, local expertise, and extensive product access to ensure consumer satisfaction and enhance product quality, further fueling the growth of the market. The segment also aids management of complex supply chains and helps startups and large food management services, which are helpful for the growth of the market.

The online channels segment is expected to grow in the foreseeable period due to high demand for high-tech and technologically advanced equipment, which is helpful for the growth of the food service equipment market. Higher demand to address digital demands, enhanced traceability, reduced waste, higher sales, improving consumer experience, enabling data analytics for improved efficiency, and increasing online orders also help to fuel the growth of the market. Technologically advanced equipment connected with AI and IoT to enhance efficiency also helps to fuel the market’s growth.

Application Analysis

The commercial kitchens segment led the food service equipment market in 2025, due to rising demand for food due to the growing population. High demand for different types of food service outlets, such as quick service restaurants, restaurants, and cloud kitchens, leading to higher demand for enhanced food quality, quantity, and efficiency in food preparation, also propels the growth of the market. Technologically advanced equipment also ensures the maintenance of sustainability and manages resources, further aiding the market’s growth.

The cloud kitchens segment is expected to grow in the foreseeable period due to higher demand for convenient options and growing food delivery services, which are helpful for the growth of the market. Higher demand for food delivery services by consumers with a hectic lifestyle is a major factor for the growth of the food service equipment market. Higher demand for cost-effective, data-driven, and efficient solutions also helps to aid the market’s growth.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Food Service Equipment Market

- ITW Food Equipment Group (Tier-1): ITW Food Equipment Group is a global leader in commercial kitchen equipment, offering a diversified portfolio across cooking, warewashing, refrigeration, and food preparation. Its strong aftermarket services, brand strength, and focus on standardized solutions position the company to benefit from replacement demand and large-scale QSR and institutional kitchen rollouts.

- Welbilt (Tier-1): Welbilt is a major supplier of integrated foodservice equipment solutions, serving global restaurant chains, hospitality operators, and institutional kitchens. The company’s emphasis on energy efficiency, workflow optimization, and scalable kitchen systems strengthens its role in high-volume QSR and cloud kitchen expansion worldwide.

- Rational AG (Tier-1): Rational AG is widely recognized for its intelligent cooking systems, particularly combi ovens and connected kitchen technologies used in professional foodservice operations. Its leadership in automation and digital cooking solutions aligns strongly with industry demand for labor efficiency, consistency, and high-throughput kitchen performance.

- Electrolux Professional (Tier-1): Electrolux Professional delivers a broad range of foodservice equipment with a strong focus on sustainability, compliance, and energy-efficient design. The company’s global footprint and ESG-driven product strategy support long-term growth as operators prioritize environmentally responsible and regulation-ready kitchen infrastructure.

- Hobart (ITW): Hobart, a flagship brand within ITW, is a leading provider of commercial warewashing and food preparation equipment used extensively in institutional and large-scale kitchens. Its reputation for reliability and hygiene compliance drives consistent demand from hospitals, schools, and high-volume foodservice operators.

- Manitowoc Foodservice: Manitowoc Foodservice is a well-established player in ice machines and refrigeration solutions serving restaurants, hospitality venues, and beverage-focused outlets. Ongoing replacement cycles and rising demand from QSRs and convenience foodservice formats continue to support its market presence.

- Hoshizaki: Hoshizaki is a global manufacturer of commercial refrigeration and ice machines, known for durable, performance-driven equipment. The company’s expansion into cost-efficient product lines enhances its competitiveness in emerging markets while maintaining strong brand loyalty in mature regions.

- Panasonic Commercial: Panasonic Commercial leverages its electronics and automation expertise to deliver advanced refrigeration and cooking solutions for foodservice applications. Its focus on smart, connected equipment positions the company to benefit from the growing adoption of IoT-enabled and data-driven commercial kitchens.

- Duke Manufacturing: Duke Manufacturing specializes in hot-holding, serving, and workflow solutions tailored to quick-service and chain restaurant environments. Its equipment supports speed, consistency, and operational standardization, making it a key partner in scalable QSR kitchen formats.

- Alto-Shaam: Alto-Shaam is a recognized leader in cook-and-hold and food preservation technologies that enhance product quality while reducing waste. The company’s solutions align with operator needs for labor optimization, extended holding times, and consistent food output.

- True Manufacturing: True Manufacturing is a prominent supplier of commercial refrigeration equipment used across restaurants, supermarkets, and institutional foodservice operations. Rising emphasis on food safety, cold-chain reliability, and energy efficiency continues to drive demand for its product portfolio.

- Fagor Industrial: Fagor Industrial provides comprehensive commercial kitchen equipment and turnkey solutions, with strong penetration in Europe and Latin America. Its integrated system capabilities support large hospitality, catering, and institutional foodservice projects requiring end-to-end kitchen infrastructure.

-

Haier Smart Catering: Haier Smart Catering focuses on intelligent and connected kitchen solutions designed for modern, high-volume foodservice environments. Supported by Haier’s manufacturing scale and digital ecosystem, the company is well positioned to capture smart kitchen adoption across Asia Pacific and emerging markets.

Segments Covered in the Report

By Equipment Type

- Cooking Equipment

- Refrigeration Equipment

- Food Preparation Equipment

- Warewashing Equipment

- Storage & Holding Equipment

- Serving Equipment

By End-user

- Full-service Restaurants (FSR)

- Quick Service Restaurants (QSR)

- Hotels & Resorts

- Catering & Banquet Services

- Institutional (Hospitals, Schools, Corporate)

By Distribution Channel

- Direct Sales

- Dealers & Distributors

- Online Channels

By Application

- Commercial Kitchens

- Institutional Kitchens

- Cloud / Ghost Kitchen

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5967

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.