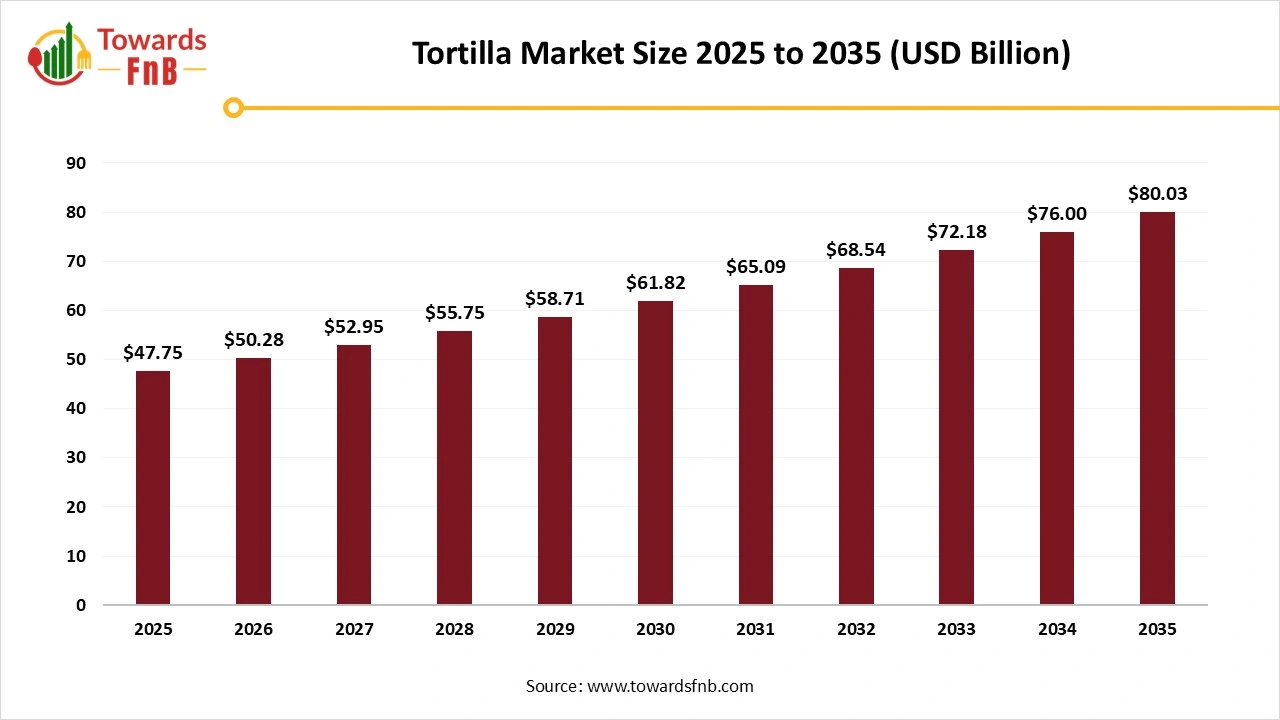

Tortilla Market Size to Worth USD 80.03 Billion by 2035, Driven by Growing Demand for Convenient and Flavorful Meal Solutions

According to Towards FnB, the global tortilla market size is calculated at USD 50.28 billion in 2026 and is expected to reach USD 80.03 billion by 2035, expanding at a CAGR of 5.3% during the 2026 to 2035 forecast period. This growth reflects the increasing preference for versatile, convenient food options, aligning with consumer demands for both quick meal solutions and authentic flavors.

Ottawa, Jan. 30, 2026 (GLOBE NEWSWIRE) -- The global tortilla market size was valued at USD 47.75 billion in 2025 and is predicted to grow from USD 50.28 billion in 2026 to reach around USD 80.03 billion by 2035, as reported by Towards FnB, a sister firm of Precedence Research. This growth is largely driven by shifts in eating habits, with consumers seeking more convenient, on-the-go food choices that also fit their busy lifestyles.

The market is observed to grow due to higher demand for convenient and ready-to-eat food options by consumers with a hectic lifestyle. The market is also expected to grow due to the higher demand for Mexican and Tex-Mex cuisine globally.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5994

Key Highlights of the Tortilla Market

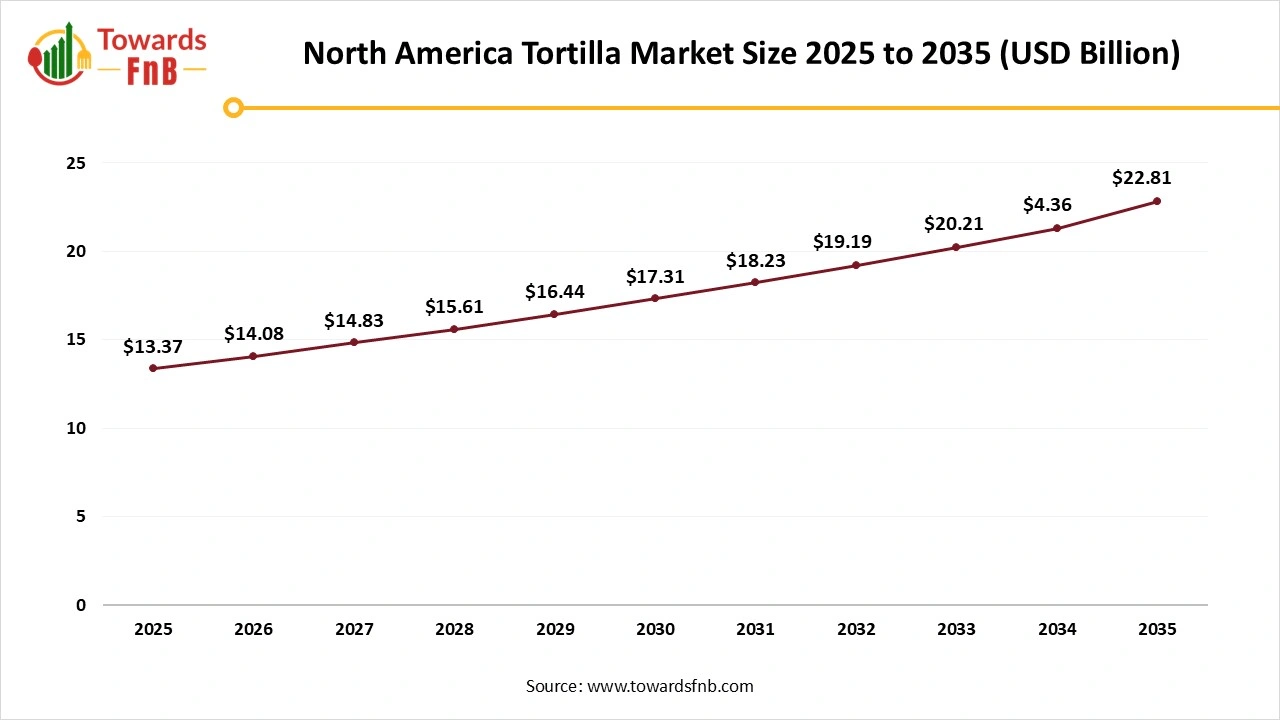

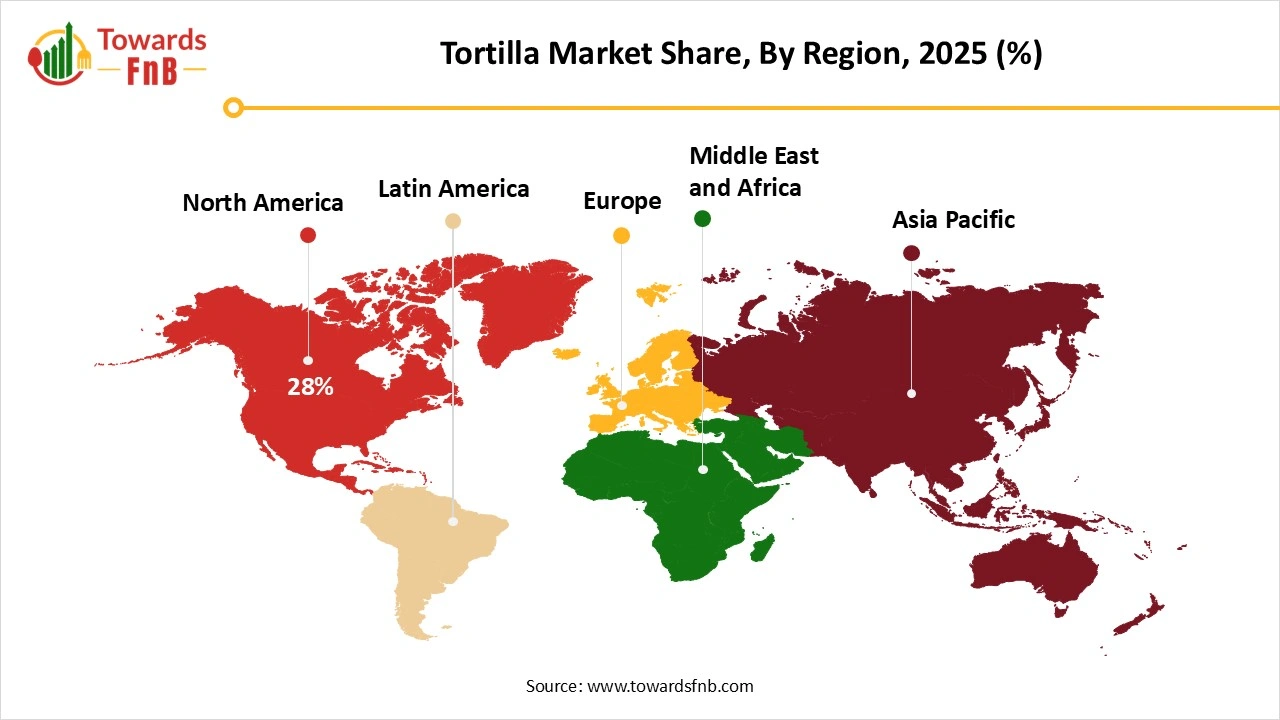

- By region, North America led the tortilla market with largest share of 28% in 2025, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By product, the tortilla chips segment led the tortilla market in 2025, whereas the tortilla shells segment is expected to grow in the foreseeable period.

- By source, the corn segment led the tortilla market in 2025, whereas the wheat segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarkets/hypermarkets segment dominated the tortilla market in 2025, whereas the online retail segment is expected to grow in the foreseen period.

Higher Demand for Innovative and Healthier Options Fueling the Growth of the Tortilla Industry

The tortilla market is observed to grow due to higher demand for convenient, flavorful, and healthier options by consumers globally. The market is also observed to grow due to higher demand for convenient, healthy, and diet-friendly options by consumers of different age groups. Rapid urbanization, rising disposable income, and higher demand for clean-label, functional, and fortified options also help to elevate the growth of the market. Changing dietary preferences of health-conscious consumers is also a major market driver.

Technological Advancements Fueling the Growth of the Tortilla Market

Technological advancements in the form of automation, AI, advanced extraction methods, and various other formats have helped to fuel the growth of the market. Such advancements have also helped to extend the shelf life of the product, further fueling the growth of the market. Making the product fortified and helping consumers to get a digestive-friendly, healthy, gluten-free, and diabetic-friendly option is another major factor fueling the growth of the market.

Impact of AI on the Tortilla Market

Artificial intelligence is increasingly being applied across the global tortilla market to improve dough consistency, process control, and yield stability in both industrial and regional production environments. Machine learning models analyze variability in corn and wheat flour characteristics, nixtamalization parameters, hydration behavior, and enzyme activity to optimize formulations that deliver consistent dough machinability, extensibility, and finished texture despite fluctuations in raw material quality across growing regions. In production, AI-driven process control systems monitor mixing energy, sheeting thickness, baking temperature profiles, and moisture loss in real time, enabling dynamic adjustments that reduce cracking, blistering defects, and weight variability across high-speed tortilla lines.

AI is also used to optimize shelf-life performance by modeling interactions between emulsifiers, preservatives, and packaging conditions to manage staling, flexibility retention, and mold risk during extended distribution and export. From an operational perspective, AI supports predictive maintenance and throughput optimization for presses, ovens, and cooling systems, helping manufacturers minimize downtime and energy inefficiency. On the quality and compliance side, AI assists in specification harmonization and labeling alignment by mapping ingredient usage and processing outcomes against international food safety and compositional standards referenced by the Food and Agriculture Organization and the Codex Alimentarius Commission.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/tortilla-market

Recent Developments in Tortilla Market

- In November 2025, Cornitos, a made-in-India brand renowned for its nacho crisps, launched two new tortilla wrap flavors; spinach and multigrain. These wraps have a perfect balance of nutrition and flavor.

- In August 2025, Mission Foods launched new gluten-free chickpea tortillas in its Better for You range. These tortillas are made from roasted chickpeas and have no artificial colors.

New Trends of the Tortilla Market

- The growing health and wellness trends leading to higher demand for low-carb, high-protein, and high-fiber food options that are also convenient are one of the major factors helpful for the growth of the market.

- The growing population of vegans and vegetarians is another major factor fueling the growth of the market.

- Convenient food options, such as ready-to-eat tortilla meal boxes and ready-to-eat wraps, to save time, are another major factor helpful for the growth of the market.

Product Survey of the Tortilla Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Corn Tortillas | Traditional tortillas produced from nixtamalized corn for authentic texture and flavor | White corn, yellow corn, blue corn variants | Retail packaged foods, foodservice, QSR chains | Traditional corn tortilla lines |

| Flour Tortillas | Wheat flour-based tortillas offering softness and flexibility | Standard, burrito-size, wrap formats | Retail, foodservice, quick-service restaurants | Soft flour tortilla products |

| Whole Wheat Tortillas | Tortillas made with whole wheat flour for added fiber content | 100% whole wheat, blended wheat variants | Health-focused retail brands, foodservice | Whole wheat tortilla ranges |

| Gluten-Free Tortillas | Tortillas formulated without gluten-containing grains | Corn-based, rice-based, cassava-based | Gluten-free and specialty diet consumers | Gluten-free tortilla products |

| Low-Carb Tortillas | Tortillas formulated with reduced net carbohydrates | Fiber-enriched, keto-positioned variants | Low-carb and keto consumer segments | Low-carb tortilla formulations |

| Organic Tortillas | Tortillas produced using certified organic ingredients | Organic corn, organic wheat variants | Organic and clean-label food brands | Certified organic tortillas |

| Frozen Tortillas | Tortillas produced for frozen distribution and extended shelf life | Frozen corn and flour tortillas | Foodservice, institutional buyers | Frozen tortilla products |

| Ready-to-Use Tortilla Wraps | Tortillas optimized for wraps, tacos, and ready meals | Soft wrap tortillas, flavored wraps | QSR chains, meal kit companies | Wrap-style tortilla products |

| Specialty Flavored Tortillas | Tortillas infused with herbs, spices, or vegetable ingredients | Spinach, tomato, herb-flavored variants | Premium retail and foodservice | Flavored tortilla lines |

| Private Label Tortillas | Contract-manufactured tortillas produced for retailers and distributors | Store-brand corn and flour tortillas | Retail chains, foodservice distributors | Private-label tortilla products |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5994

Tortilla Market Dynamics

What are the Growth Drivers of Tortilla Market?

Higher demand for flavorful and culinary options that are also healthy is one of the major factors for the growth of the market. Availability of baked, air-fried, and other healthier options also helps to fuel the growth of the market. Higher demand for flavorful and innovative options, such as Tex-Mex and Mexican snacks and cuisine, is helpful for the growth of the market. Higher demand for convenient and ready-to-eat food options, such as taco shells and tortillas, is another major factor helpful for the growth of the market. Product innovation, such as low-sugar and low-sodium options to attract health-conscious consumers, also helps to fuel the growth of the market.

Challenge

Supply Chain Issues Hampering the Growth of the Market

Difficulty in supplying raw materials and other essential products to the market on time is one of the major restrictions in the growth of the market. Harsh climatic conditions, geopolitical factors, and rising labor costs are some of the major issues restricting the growth of the market. Hence, such factors altogether hamper the growth of the market.

Opportunity

Higher Demand for Healthier and Ready-To-Eat Options Is Helpful for the Growth of the Tortilla Market

Higher demand for convenient and ready-to-eat options that are also nutritious is one of the major opportunities for the growth of the market. Such options have a huge consumer base of people who have a busy schedule and also who do not wish to skip out on healthier meal options. Hence, tortillas made from wheat and the ones that are baked and air-fried have a huge demand, further fueling the growth of the market. Higher demand for innovative and flavorful Mexican options also helps elevate the growth of the market.

Tortilla Market Regional Analysis

North America Dominated the Tortilla Market in 2025

North America led the tortilla market in 2025, due to higher demand for wheat tortillas, baked and air-fried options, and other healthier versions, fueling the growth of the market in the region. Higher demand for health-friendly food, snacks, and beverages also helps to fuel the market’s growth in the foreseeable period. Availability of different types of diet-friendly options, such as keto-friendly and gluten-free options, also helps to propel the market. The US has made a major contribution to the growth of the market due to higher demand for clean-label, digestive, healthier, fortified, and functional options, fueling the growth of the market.

Asia Pacific is Expected to Grow in the Foreseen Period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to growing disposable income, rapid urbanization, and a growing shift of consumers towards healthier options. Higher demand for healthier options, such as clean-label, fortified, functional, and diet-friendly options, is helpful for the growth of the market in the foreseeable period. Technological advancements and rising health awareness are other major factors fueling the growth of the market. India has made a major contribution to the growth of the market due to growing disposable income and higher demand for healthier options, such as low-sugar, high-fiber, sustainable, and clean-label options, which are helpful to fuel the growth of the market.

Europe is Observed to have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to highly preferable options in the region, such as clean-label, functional, fortified, and diet-friendly options. The market also observes growth due to a huge consumer shift towards food and beverage options that help to aid lifestyle-related health problems, further propelling the growth of the market. Higher demand for Mexican cuisine and its innovative food options also helps to elevate the growth of the tortilla market. Germany has made a major contribution to the growth of the market due to higher demand for Mexican cuisine, vegan, and plant-based options, which is helpful for the market’s growth.

Trade Analysis for the Tortilla Market

What Is Actually Traded (Product Forms and HS Proxies)

- Tortillas and flatbreads made from maize (corn) or wheat flour intended for human consumption are commonly traded under HS 19059090 (other breads, including tortillas) for finished products such as corn and flour tortillas used in retail and foodservice. (Common customs classification practice)

- Prepared tortilla products including wraps and similar flatbreads intended for packaging and sale in retail channels are also classified under HS 19059080/19059090 depending on specific national tariff definitions of flatbreads and similar bakery products. (Global trade data uses these codes for tortilla products)

- Frozen tortillas and chilled tortillas are often declared under the broader HS heading 1905 (bread, pastry, cakes, biscuits and other bakers’ wares) when shipped in chilled or frozen form, with subheadings reflecting frozen preparations. (Used in global import data for frozen tortilla shipments)

- Corn masa flour and tortilla mixes that serve as inputs for local production of tortillas may be traded under HS 1101 or adjacent grain/flour classifications, forming part of the supply input chain for tortilla production. (Related global trade classification practice)

-

Packaging materials for tortilla products such as trays, bags, and wraps are classified separately (e.g., HS 3923 for plastic sacks and containers) and are excluded from core product trade totals.

Top Exporters (Supply Hubs)

- United States: A major exporter of tortillas and tortilla products, supplying both finished tortillas and related flatbreads to regional and global markets; U.S. exporters account for a large share of tortilla import entries under HS 19059090 in some datasets. (Customs import data show U.S. origin dominance for tortilla shipments)

- Mexico: While not always explicitly detailed in public HS export summaries, Mexico is globally recognised as a major producer of tortillas and corn flour products and home to the world’s largest branded tortilla manufacturer, Gruma, which operates globally and supports substantial cross-border shipments of tortilla products and inputs.

- India: Appears as a significant source country in global data for tortilla and flatbread imports, supplying finished tortillas into a variety of markets based on shipment counts for HS 19059090. (Volza data on exporter counts includes India prominently)

- Turkey and other producers are visible in HS 190590800019 shipment records, reflecting active exporting roles, especially in niche regional markets for tortilla wraps and specialty flatbreads. (Trade shipment listings show Turkish exporter activity)

Top Importers (Demand Centres)

- United States: Large importer of tortilla products, both finished and niche specialty products, reflecting diverse consumer demand and a significant domestic processing sector that also re-exports regional products. (U.S. customs data identifies the U.S. as a leading destination under HS 19059090)

- European Union: Collectively a major importer of tortillas and tortilla wraps, driven by retail trends, foodservice expansion, and growing demand for ethnic and convenience foods across member states. (Trade flow patterns for HS 19059090 tortillas show diverse EU import activity)

- Middle East & Africa: Markets such as United Arab Emirates, Qatar, and Lesotho appear consistently among top import destinations for frozen tortilla and related products, indicating rising demand in these regions. (Global frozen tortilla import data highlights these countries)

- Asia Pacific: Countries such as South Korea and the Philippines feature among import destinations for tortillas, reflecting expanding retail and foodservice categories. (Import shipment counts for HS 19059090 reference these markets)

Typical Trade Flows and Logistics Patterns

- Finished tortilla shipments move primarily via containerized sea freight due to bulk retail packaging and expiry considerations, with temperature-controlled logistics used for frozen products.

- Chilled and frozen tortillas are shipped with supplementary refrigeration or insulated transport to preserve quality and extend shelf life in destination markets.

- Regional distribution hubs support repackaging, compliance labeling, and inventory staging ahead of retail and foodservice supply.

- Bulk shipments of tortilla mixes or corn flour inputs feed into local production facilities near demand centers to reduce finished product freight costs.

Trade Drivers and Structural Factors

- Globalization of food preferences and rising demand for convenience and ethnic foods support sustained import volumes of tortilla products in non-traditional markets.

- Retail expansion and quick-service restaurant growth drive demand for tortillas and wraps across multiple geographies.

- Food safety and quality consistency expectations encourage importers to source standardized products from established exporters.

- Input cost fluctuations in corn and wheat markets influence trade patterns for both finished tortillas and production inputs such as corn flour.

Regulatory, Quality, and Market-Access Considerations

- Tortilla products must comply with food safety and labeling regulations in importing countries, including ingredient declarations and permissible preservative limits.

- HS classification choices (e.g., distinguishing HS 19059090 for tortillas vs broader bakery headings) affect tariff application and documentation requirements.

- Certificates of origin, sanitary declarations, and, where applicable, halal/kosher certifications influence market-access outcomes.

Government Initiatives and Public-Policy Influences

- Policies that support agricultural value chains for corn and wheat influence the availability of inputs for tortilla production in exporting nations.

- Food safety and import licensing regimes impact processing standards required prior to market entry.

- Trade facilitation agreements and customs harmonization affect tariff rates and procedural ease for tortilla imports and exports.

Tortilla Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 5.3% |

| Market Size in 2026 | USD 50.28 Billion |

| Market Size in 2027 | USD 52.95 Billion |

| Market Size in 2030 | USD 61.82 Billion |

| Market Size by 2035 | USD 80.03 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Tortilla Market Segmental Analysis

Product Analysis

The tortilla chips segment led the tortilla market in 2025, due to its higher demand by consumers of different age groups. The chips are convenient and easy to consume on the go, and hence are preferred by consumers in search of convenient and healthier options. Availability of baked and air-fried options is another major factor propelling the growth of the market. The chips can be enjoyed with different flavors of dip, guacamole, and salsa. Hence, it is a flavorful and ideal snack for consumers of different age groups.

The tortilla shell segment is observed to grow in the foreseen period due to higher demand for Mexican food options and variety, which is helpful for the growth of the market. The crispy texture of tortilla shells attracts food vloggers and bloggers all around the world, along with food enthusiasts, further propelling the market’s growth in the foreseeable period. The shells are available in healthier versions as well, with healthier sauces, elevating the market’s growth in the foreseeable period. Convenience, sustainability, versatility, and adaptability are also some of the major factors fueling the growth of the market.

Source Analysis

The corn segment led the tortilla market in 2025, due to its higher demand by consumers of different age groups, fueling the growth of the market. The market also observes growth due to higher demand due to its versatility, authentic flavor, and higher demand by the health-conscious consumers, further fueling the market’s growth. Corn tortillas are highly demanded by consumers, as they are a traditional cuisine of Latin America and Mexican cuisine, further fueling the growth of the market.

The wheat segment is observed to be the fastest-growing segment in the foreseen period, due to higher demand for the form by consumers of different age groups. Easy availability, higher demand, higher manufacturing quantity, and longer shelf life are other major factors fueling the growth of the market. The market also observes growth due to the gluten protein found in wheat, which is helpful to make soft, flavorful, and flexible tortillas, highly demanded by consumers, further fueling the growth of the market.

Applications Analysis

The supermarkets/hypermarkets segment led the tortilla market in 2025, due to higher demand for such stores by consumers and their easy availability near residential areas, which is helpful for the growth of the market. Such stores have separate sections for newly launched and innovative products, which is further helpful for the growth of the market. The market also observes growth due to the easy availability of different types of products in a single store, allowing consumers to choose from the huge product portfolio, fueling the market’s growth. Such stores also provide heavy discounts and schemes to their loyal consumers, further helping to fuel the growth of the market.

The online retail segment is observed to be the fastest-growing region in the foreseen period due to the convenience provided by the platform, further fueling the growth of the market in the foreseen period. The segment also observes growth due to the huge product portfolio on online platforms, allowing consumers to do proper research of products and select the right one accordingly. Availability of heavy discounts and coupons is also helpful to fuel the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

-

Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Strategic Moves by Top Companies Reshaping the Global Tortilla Market Landscape

- PepsiCo Inc.: PepsiCo, through its subsidiary Frito-Lay, is a global leader in the snack and tortilla market with well-known brands like Doritos and Tostitos. The company's ability to leverage its extensive distribution network, product innovation, and brand recognition enables it to maintain a dominant position in the market. PepsiCo’s focus on healthier tortilla options and AI-driven production technologies positions it to meet the rising demand for convenient, flavorful, and health-conscious food products, ensuring continued market growth.

- GRUMA Corporation: GRUMA is a global leader in the tortilla and corn flour market, best known for its flagship brand Maseca. With a strong presence in North America, Latin America, and Europe, GRUMA has a significant share of the market, driven by its commitment to high-quality, versatile tortillas. Its strategic focus on sustainability, innovation, and expansion into emerging markets will help GRUMA capitalize on the growing demand for clean-label, gluten-free, and health-focused products.

- La Tortilla Factory: La Tortilla Factory is a major player in the tortilla market, specializing in healthier, low-carb, high-fiber, and gluten-free tortilla products. Its commitment to offering dietary-specific products appeals to health-conscious consumers, especially in North America. The company’s focus on innovation in the health-conscious food sector gives it a competitive edge, positioning it well to benefit from the rising demand for functional, clean-label foods.

- Aranda's Tortilla Company Inc.: Aranda’s Tortilla Company, known for its authentic Mexican tortillas, specializes in traditional production methods using high-quality ingredients. With a focus on authenticity and premium offerings, the company has built a strong niche in the tortilla market. As global demand for Mexican and Tex-Mex cuisine grows, Aranda’s ability to provide high-quality, flavorful products positions it for sustained success in the global market.

- Catallia Mexican Foods: Catallia Mexican Foods is renowned for its premium tortillas and wraps, including gluten-free and organic tortillas. The company’s focus on clean-label, health-conscious products aligns with growing consumer preferences for natural, nutritious foods. With an emphasis on innovation and premium quality, Catallia is well-positioned to capitalize on the increasing demand for healthier tortilla options, ensuring its continued market expansion.

- Azteca Foods Inc.: Azteca Foods, a subsidiary of Mission Foods, is recognized for its authentic and premium tortillas, serving both retail and foodservice customers. The company’s focus on providing high-quality, convenient tortilla products has helped it secure a significant market share in North America. With its growing portfolio of gluten-free, low-sodium, and functional options, Azteca is poised to capitalize on the rising demand for healthier and more sustainable food choices.

- Arevalo Tortilleria Inc.: Arevalo Tortilleria is a family-owned business that specializes in producing fresh, authentic corn and flour tortillas. The company prides itself on its traditional production methods, ensuring high-quality products that cater to local tastes. With the increasing global demand for authentic Mexican food, Arevalo is well-positioned to grow its market share by expanding its product range and meeting the evolving preferences of health-conscious consumers.

- Easy Foods Inc.: Easy Foods is a leading tortilla manufacturer offering a wide range of tortilla products, including flavored tortillas and tortilla chips. The company’s emphasis on convenience and innovation has made it a popular choice for both retail and foodservice markets. By tapping into the growing demand for on-the-go, flavorful meals, Easy Foods is strategically positioned to meet changing consumer needs and capture a larger share of the expanding tortilla market.

- Ole Mexican Foods Inc.: Ole Mexican Foods, a major manufacturer of tortillas and tortilla chips, offers a diverse product range including traditional, gluten-free, and organic tortillas. With its strong presence in North America and expanding market reach, Ole is capitalizing on the increasing demand for authentic and healthier Mexican food options. The company’s focus on continuous product innovation, especially in the health-conscious segment, ensures it remains competitive in the dynamic tortilla market.

- General Mills Inc.: General Mills, known for its well-established Old El Paso brand, produces a variety of tortilla products, including taco kits, tortillas, and chips. The company’s extensive distribution network and brand recognition allow it to dominate the market. General Mills is focusing on product innovation, particularly in gluten-free and organic tortillas, to meet the growing demand for healthier, convenient meal solutions, positioning itself for long-term growth in the tortilla market.

Segments Covered in the Reports

By product

- Tostadas

- Taco Shells

- Tortilla Chips

- Others

By Source

- Wheat

- Corn

By Distribution Channel

- Hypermarket/Supermarket

- Convenience Stores

- Online Retail stores

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5994

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.